... the easy way. After all, who wants to pass it the hard way, eh? When I was finishing my undergraduate degree in accounting at Indiana University, I was quite apprehensive about the CPA exam. Several of my friends were a year ahead of me and, although they were pretty much straight-A/A- types, they had horror stories about how hard and how long the CPA exam was. So, not being the straight-A type I decided to postpone writing the CPA exam until I got out of school and had plenty of time to study. Everyone told me this was a Bad Idea: "You'll forget everything you studied in school and the CPA exam is a textbook exam." Nonetheless I waited ...

On my first job as an auditor I traveled pretty much all over the US (except for Las Vegas and Salt Lake City ... my employer wanted us to avoid the extremes, I suppose) and traveled a lot; I was gone 39 weeks in my first year. Because I didn't want to watch TV at night in the hotel, I decided I would take the Becker CPA Review course and be productive instead. This didn't work well at all. First, I almost killed myself and other drivers trying to get from the client to where the course was meeting at some unknown strip mall in New Jersey (for example) by the 7:30pm start time. Then, I immediately noticed the course went far too quickly through things I didn't understand and far too slowly through things I did. Finally, there was the problem of spending, as I recall, six hours on Saturday back in Chicago studying accounting in the same fast/slow way after an exhausting week in Great Bend, Kansas (my boss, Keith, was there to "help" and pour beer over my head at the restaurant that week).

So, I quickly dropped the Becker course, got about a 75% refund of the course fee, and decided to use Gleim CPA Review instead. Being the obedient quasi-Catholic accountant I am, I followed the studying recommendations of Gleim religiously ... for about a month and a half. Then after a several month study sabbatical, I recommenced my studies two weeks before the exam. Perhaps no one in the world was more shocked than I when I got my exam scores indicating I passed all parts of the exam except Business Law (the only thing I hadn't studied at all). Needless to say, this stunning turn of events after all my straight-A friends had said the CPA exam was so hard made me think: Why was the exam easy for me?

Being the social scientist and educational psychologist I am, I spoke with my friends quite a bit about their CPA experiences and delved in to how they studied and understood accounting. After a series of conversations with my friends and other accountants, and after much reflection and introspection, I realized there was only one possible explanation for why the CPA exam had been so easy for me and so difficult for others: I had never been taught or burdened with The Great Anachronism of Accounting Education, the "T account". Instead I had learned accounting when I was 16 from my first instructor at Indiana University, Jamie Pratt, as applied algebra; and I had always put financial accounting into an algebraic structure ever after.

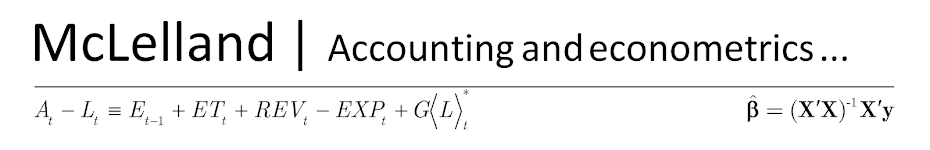

Because eschewing "T accounts" is nigh on blasphemy in accounting, I will not try to sway the Esteemed Reader with rhetoric but will resort instead to the Socratic Method to make my point. Consider the following problem adapted from a prior year CPA exam problem published in Wiley's CPA Exam Review; a fairly common type of problem that tests whether one understands basic accounting concepts and relationships among the concepts, and can apply the understanding in solving an accounting problem:

PROBLEM

Accounting data:

Accounts receivable--gross ........ $1,000 (1/1/09) and $2,000 (12/31/09)

Allowance for uncollectible accts ..... $100 (1/1/09) and $300 (12/31/09)

Cash receipts on receivables .............. $27,000 (year ended 12/31/09)

Uncollectible customer accounts written-off .................... unknown

Sales revenues .................... $30,000 (for the year ended 12/31/09)

Given the above, determine the accounting entry to recognize uncollectible accounts expense for the year ended 12/31/2009.

There, of course, is no unique way of solving the problem; I can think of at least three ways. But there is one really fast, easy way to solve the problem. To make things more interesting and suspenseful-, nd because the Socratic Method kind of requires one to actually think about the problem without being presented with the solution, DO NOT LOOK AT THE SOLUTION BELOW BEFORE YOU CONSIDER THE "T-account" METHOD OF SOLVING THE PROBLEM.

MMc

MMc

São Paulo

Step 1: Determine how net accounts receivable change over time ...

Step 1: Determine how net accounts receivable change over time ...

Step 2: Substitute the data into the equation and solve for the unknown ...

I've watched many students who understood the algebraic approach, and those who didn't (those who used the "T-account" method), solve this type of problem. The algebraic approach usually gets to a correct solution in less than five minutes with no problems; the T-account method usually takes 10-15 minutes and usually requires rework due to "problems with pluses and minuses". But I'll let the reader be the judge as to which method is best! MMc

No comments:

Post a Comment